Binance chain portfolio tracker

Other features include multi-currency support, computation of tax on unrealized gains, and even a dead man’s switch. All of that makes Kubera a premium-only crypto portfolio tracker with a free trial period, and it’s also a solid choice if you want a holistic solution for all your financial needs https://techinapk.com/zanti-wifi-hacking-apk-free/.

We like that Wallet makes it easy for users to analyze their cash flow and spot areas that need improvement. Wallet automatically categorizes your spending, identifies recurring payments and shows you your expected net cash balances to help you plan ahead.

Crypto portfolio tracker apps allow you to track historical transactions, their worth, and destinations or sources. These tools also provide the actual live price of any cryptocurrencies they support. You can monitor price changes at all hours of the day and track your investments in real time. It also allows you to store your cryptocurrency on a hardware wallet for security. Following is a handpicked list of Top Cryptocurrency Portfolio Tracker tools, their key statistics, pros and cons, and website links. The list contains open-source (free) and commercial (paid) software. Read more…

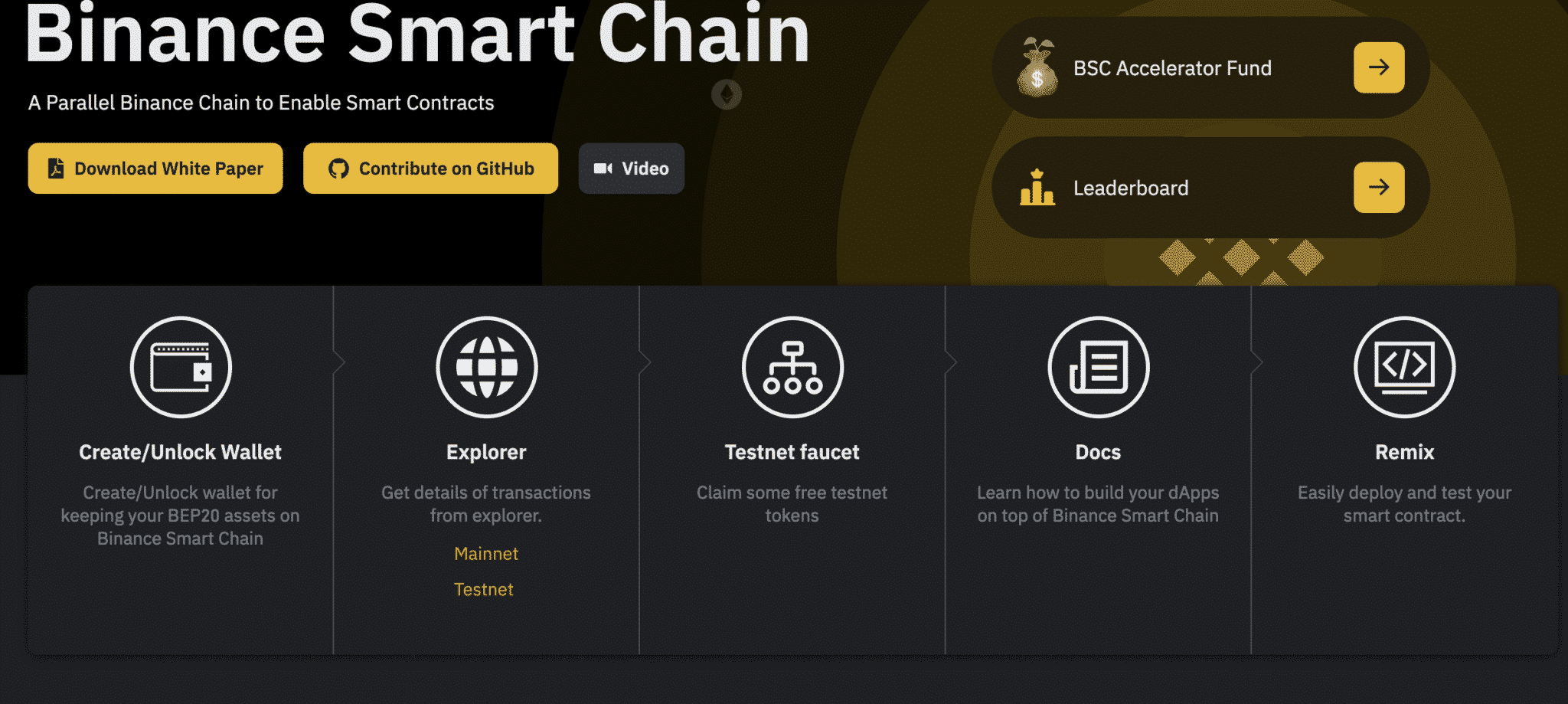

Binance smart chain price tracker

Get a comprehensive snapshot of all crypto assets available on Binance. This page displays the latest prices, 24-hour trading volume, price changes, and market capitalizations for all crypto assets on Binance. Users can quickly access key information about these crypto assets and access the trade page from here.

The live BNB price today is $763.42 USD with a 24-hour trading volume of $1,918,356,070 USD. We update our BNB to USD price in real-time. BNB is up 1.14% in the last 24 hours. The current CoinMarketCap ranking is #5, with a live market cap of $106,335,810,708 USD. It has a circulating supply of 139,288,236 BNB coins and the max. supply is not available.

Originally launched in 2017 as Binance’s exchange token, BNB was designed to offer trading fee discounts and other utilities within the Binance platform. It later evolved into the foundational asset of a much broader ecosystem. Following its mainnet launch on April 18, 2019, BNB transitioned from the Ethereum Network to BNB Chain. «Build and Build» is the philosophy behind BNB, reflecting its role in fostering development within the ecosystem.

BNB is the native coin of the BNB Chain ecosystem, essential for powering its multifaceted Web3 environment. It supports transactions on the BNB Smart Chain (BSC), the opBNB L2s, and BNB Greenfield . Besides transaction fees, BNB serves as a governance token, granting holders the ability to participate in the BNB Chain’s decentralized on-chain governance.

Disclaimer: This page may contain affiliate links. CoinMarketCap may be compensated if you visit any affiliate links and you take certain actions such as signing up and transacting with these affiliate platforms. Please refer to Affiliate Disclosure

Binance luna burn tracker

Taxing transactions on the terra classic chain accounts for approximately of the total burn. Only transactions that happen on-chain can be taxed. So this excludes trading on centralized exchanges like Binance and Kucoin.

lunaburn.online is a platform that presents the total and circulating supply of lunc on screen. The data refresh frequency is every 5 minutes. Obtained results; Groups are offered on a 5-minute, hourly, daily and monthly basis

To buy Terra Classic (LUNC), you need to follow a few steps. Firstly, you’ll need to sign up for a cryptocurrency exchange and verify your account. Once that’s done, you can purchase LUNC with a cryptocurrency available on the exchange (usually Bitcoin or Ethereum). If there’s a suitable market for LUNC on the exchange, you can place a buy order and acquire the desired amount of LUNC. It’s important to transfer the purchased LUNC tokens to a secure wallet for safekeeping.

The Luna Classic burn mechanism works by automatically burning tokens whenever a transaction occurs on the network. The number of tokens that are burned is relative to the number of tokens in circulation. This ensures that the total supply of tokens is constantly decreasing, thus increasing their value over time.

While it is hard to imagine Luna Classic reaching $1 or even $0.10 given its current tokenomics (at $1, LUNC would have a market cap of over $5 trillion, which just isn’t feasible), LUNC could still have a bright future thanks to its enthusiastic community.

The LUNA crash occurred in May 2022 when the algorithmic stablecoin TerraUSD (UST) lost its peg to the US dollar. This triggered a massive sell-off of LUNA, as the coin was used to stabilize UST. Consequently, LUNA lost its value, leading to its fork and the creation of Luna Classic (LUNC).

Add a Comment